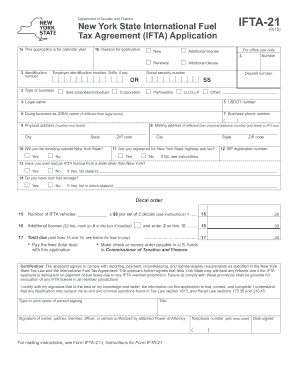

NY IFTA-21 2021-2024 free printable template

Get, Create, Make and Sign

How to edit ifta 21 online

NY IFTA-21 Form Versions

How to fill out ifta 21 2021-2024 form

How to fill out New York IFTA:

Who needs New York IFTA:

Video instructions and help with filling out and completing ifta 21

Instructions and Help about new york state ifta form

Hey guys want to do a video talk to do a little talking about fuel taxes this was a problem I had trouble understanding when we first got into trucking and understanding how the fuel taxes work and stuff, so I want to do a little video it kind of explained in how it's charged and how we build up an account every time we buy diesel so first thing the best thing to know is you want to know where what each state's tax rate is now you can find this at IFTA CH org and once you go to that website you'll go over here on the left-hand side look at tax rates gives you a complete list of all the tax rates for each state including all of Canada's and then of course all 50 states for the US few things like that something I've learned was in Indiana and Kentucky they both charge a surcharge tax on top of the fuel tax, so those are two states I typically try to shy away from because that 11 cents and 10 cents on top of the fuels text they're charging doesn't go towards any extra diesel or my IFTA account that builds up every time I buy diesel that's just wasted money, so those are kind of wasted places to buy diesel in my opinion and for instance in Kentucky ten cents I buy 200 gallons that's 20 dollars of extra tax on paying them, and they just keep that that doesn't go towards the IFTA or in my fuel tank so once you do this for a while you know you can learn I kind of got most of them all memorized what states are high what states are low Pennsylvania has the highest field tax of 64 cents well I think Oklahoma has the cheapest of 13 cents, so you know after a while of doing it you kind of get to know most of the wet state charge and where you want to buy your fuel at if you need to build up that account some with a higher fuel tax like Pennsylvania or want to save some money and go with the cheaper fuel taxes, but I guess well go ahead and start I'm going to explain how fuel tax is charged to us got a little demonstration kind of typed up here for instance I'm doing a load picking up in Los Angeles going to Nashville that is going to be a total of two thousand and four miles and what I've done is broke it down into each state how many miles I'm going to be driving through each state now each state has a different tax rate, so it's not you got to figure out each state smiles that you have driven now most companies will do this for you or a lot of gps's will calculate this for each, so this isn't something you have to do every run, but this is just kind of a demonstration to kind of show you how much tax a load from LA to Nashville two thousand four miles would be owed after driving through those states so here in California it would be — we'd be driving 256 miles to get to the Arizona border, so my truck gets ten miles a gallon a little more, but I just did ten miles — for the simplicity of it, so I would take 256 miles divided by my 10 miles a gallon which means I've burned 256 gallons in the state of California now California they will charge you that's 45...

Fill ny ifta 21 : Try Risk Free

People Also Ask about ifta 21

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ifta 21 2021-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.